Pioneers in the field of financial literacy designed three simple questions that measure the ABC’s of financial literacy, known as the Big Three. Many people find the questions challenging. How about you?

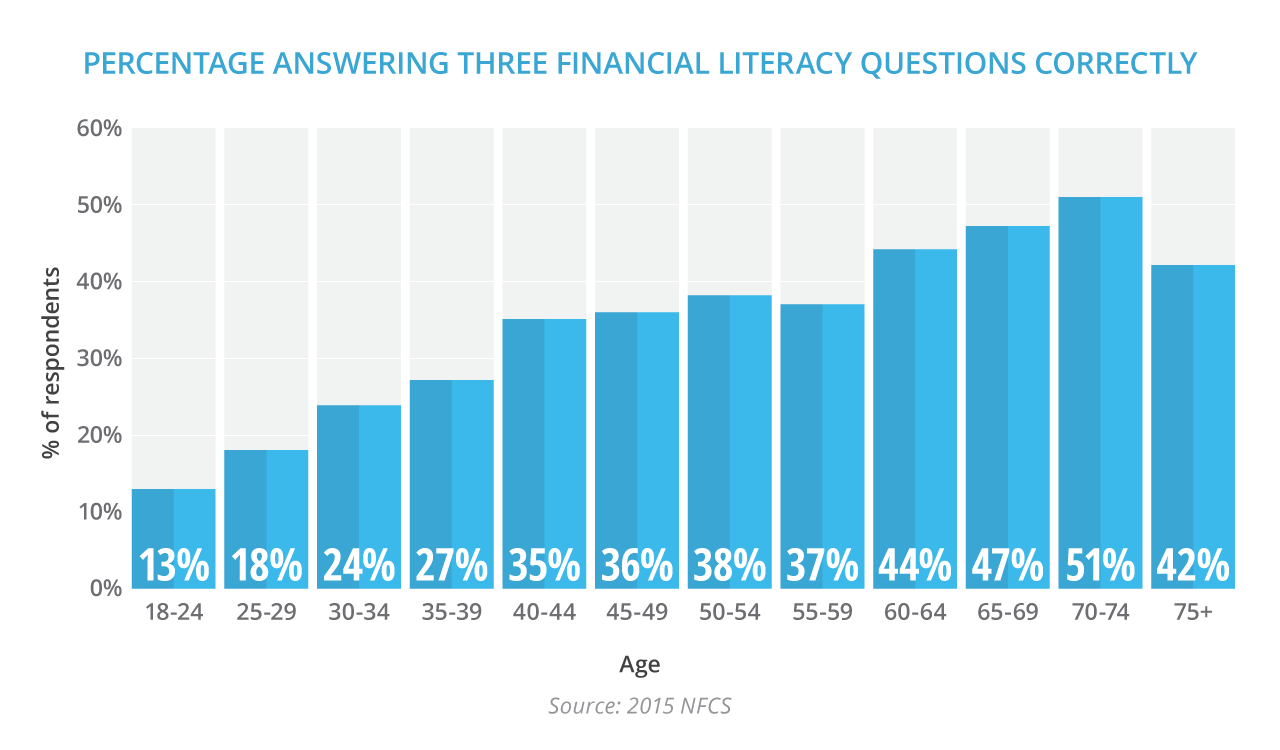

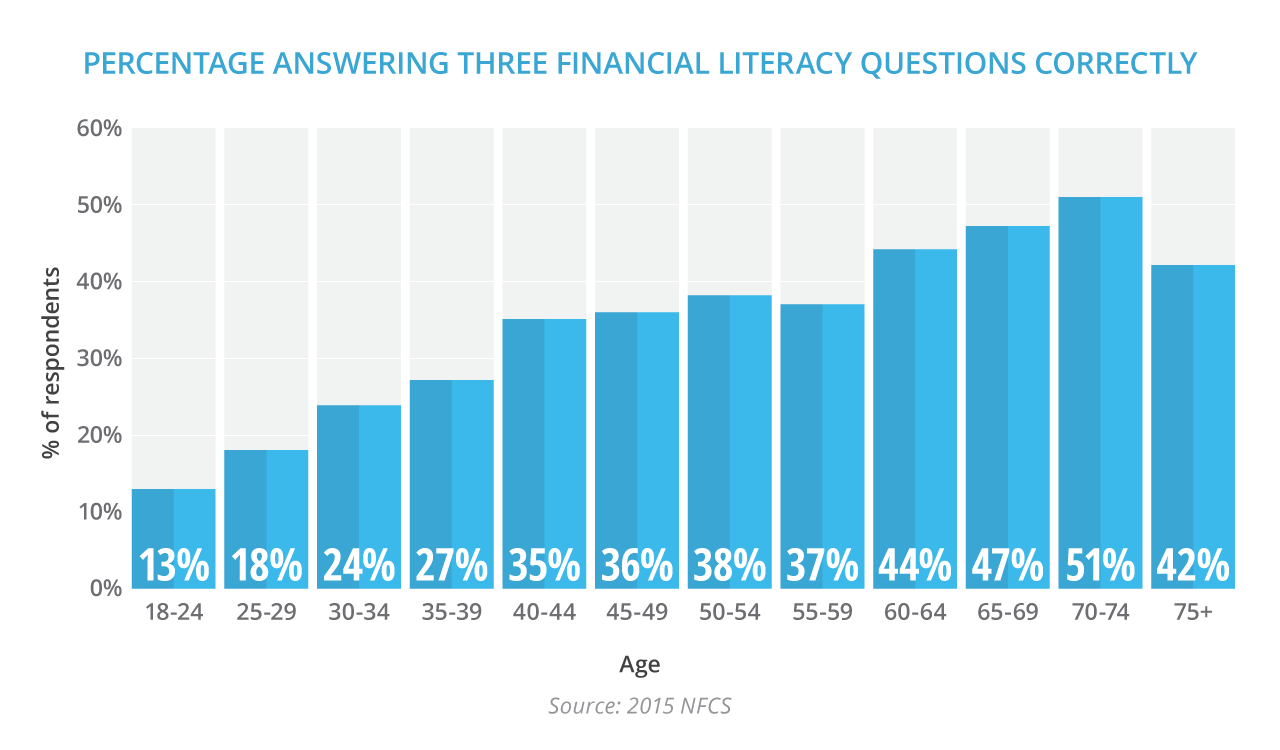

The data reveals that financial literacy is very low among the young. Financial knowledge increases slowly with age, but it remains low even as adults near retirement. That’s because experience alone isn’t enough.

By age 40, many adults have tackled a series of life-changing financial decisions. They may have earned a college education, bought a car or home, and saved for retirement. Yet only a third of these adults have made those decisions with a strong understanding of personal finance. With more financial knowledge, they may have reached their goals faster and better.

Research shows that adults with low financial literacy are more likely to turn to costly payday loans, incur late charges on their credit cards, and use other financial services that tack on high fees. Financial literacy also has long-term implications. Individuals with low financial literacy are less likely to prepare for retirement. They are also more likely to take out loans or hardship withdrawals from their retirement accounts, jeopardizing their well-being late in life. Financial literacy also matters for the short term. Those with higher financial literacy are more likely to have precautionary saving and less likely to be financially fragile.