To be free from financial worry is one of life’s great aspirations. That’s where financial literacy comes in. You can use it to your advantage every time you make a decision about money.

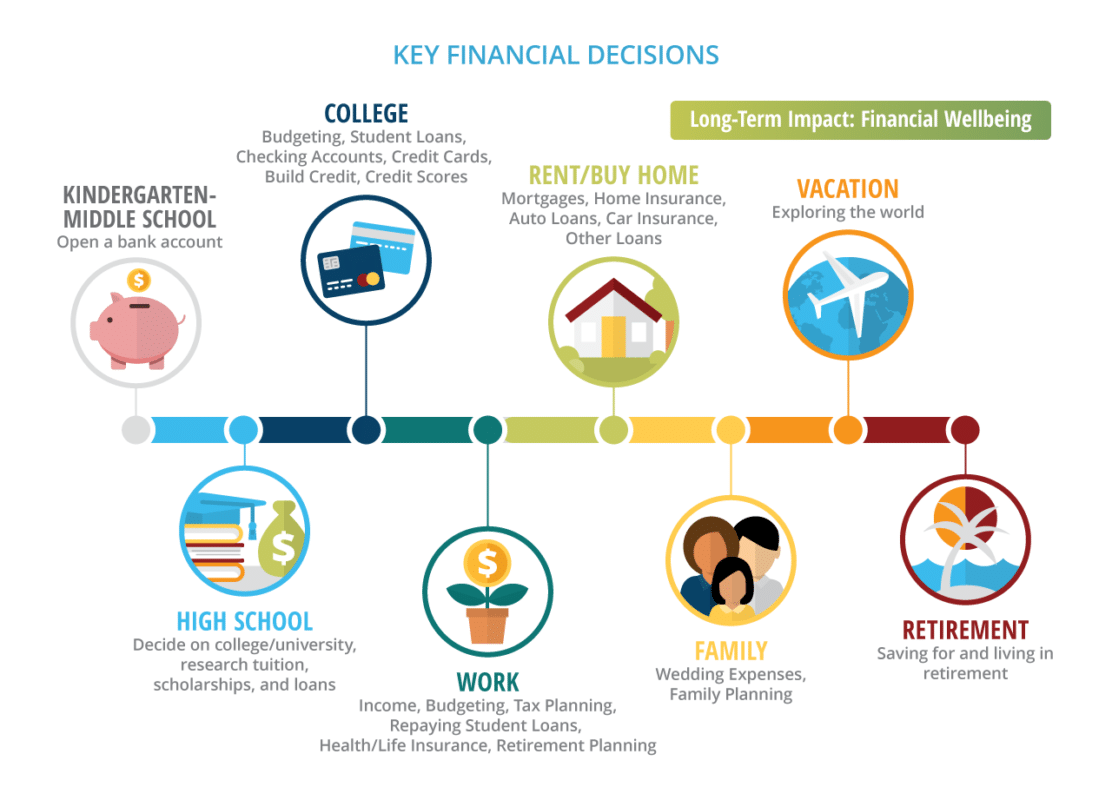

Each chapter of life requires important financial decisions, from whether to go to college to when to retire. These decisions carry lifelong consequences. If these decisions are backed by financial knowledge, they can save or make you money. Most importantly, they contribute to your financial well-being.

Small mistakes can have big price tags. Credit cards are a good example. Extra fees and expenses pile up for people who make a late payment, exceed their credit limit, take cash advances, and pay only the minimum due. Our research study shows that people with less financial knowledge are more likely to incur these charges.

Payday loans, auto title loans, pawn shops, and rent-to-own centers are expensive avenues for borrowing money. Our research shows that these borrowing methods are not uncommon among the young, with about a third of young people saying they have used them. However, financially literate people tend to be more aware of the high interest rates these options charge, and they avoid using them.

Starting to save for retirement early in life and contributing to that savings on a regular basis can build a solid foundation for the later years of your life. Our study shows that financially literate individuals are more likely to contribute early and often toward their retirement.

Research from the University of Pennsylvania reveals that individuals with lower financial knowledge do not have a good understanding of investing. They are not aware of fees, invest too little in equity, cannot identify funds that perform poorly, and do not diversify their investments appropriately. These are common mistakes—but they are also costly missteps. They can make a big difference in the returns on investments and long-term savings.

When talking about financial well-being, it’s important to look at the whole picture. That means considering both assets and debt.

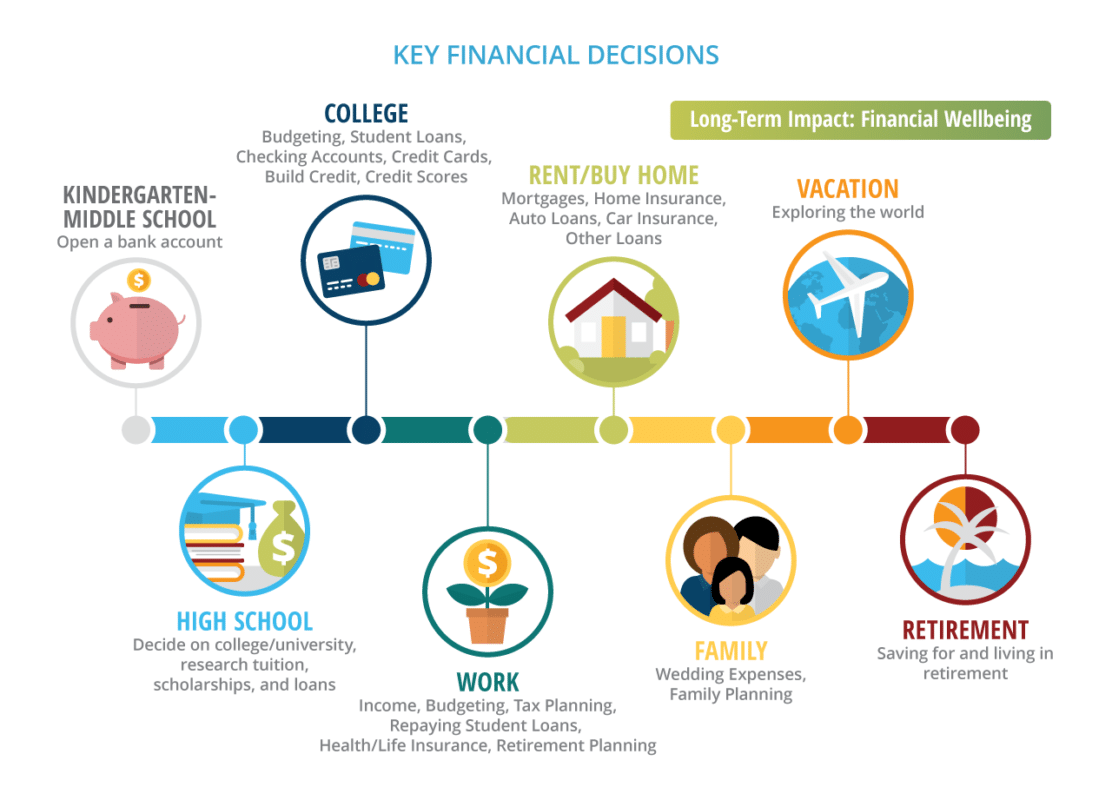

Take the Millennial generation, for example. Many Millennials are well-educated, have assets, and have some retirement savings, but they are also borrowing against their retirement accounts, carrying unpaid student loans, and racking up credit card fees.

High amounts of debt result in large debt payments each month—and that leaves little left over for unexpected needs or other spending. Even something as minor as overdrawing a checking account can lead to an avalanche of extra charges. That, in turn, causes stress that affects well-being and health.

Debt can feel so overwhelming that some people refuse to talk about it. Even thinking about it is upsetting. Yet many people deal with debt every day. Talking about it and getting more financial information helps move them toward greater financial knowledge. A strong foundation of financial knowledge can improve debt-management skills and confidence, improve well-being, and lower the stress that comes from not having enough money to pay bills or handle unexpected problems that arise.

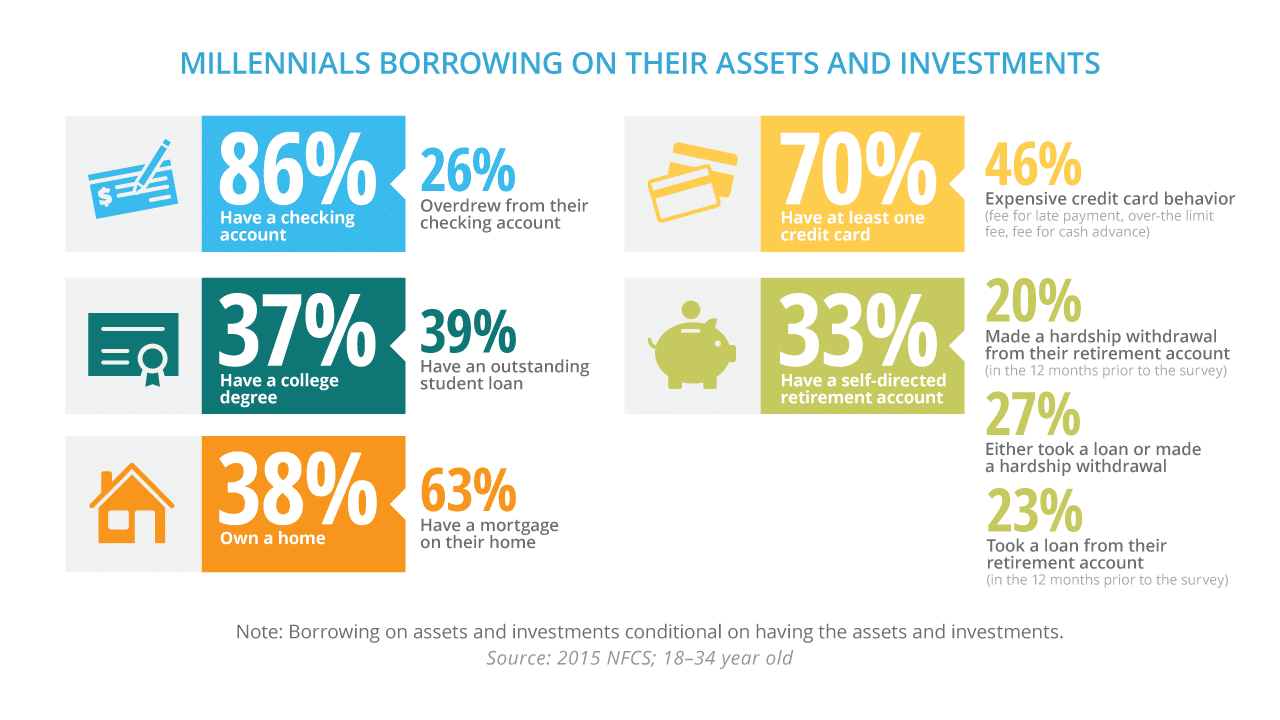

Research shows that about one-third of working-age people in the United States are financially fragile, meaning they could not handle a financial shock, such as a car breakdown or an unplanned medical expense.

Being unprepared for the unexpected makes families vulnerable. However, when people gain a better understanding of their finances, they can make smarter choices, increase their emergency savings, and become less financially fragile.